SMM June 27 Report:

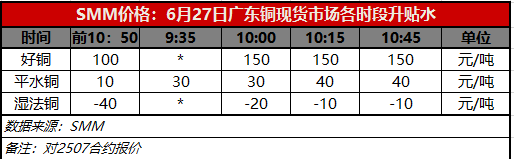

Today, in Guangdong, spot #1 copper cathode traded at a premium of 40 yuan/mt to 150 yuan/mt against the front-month contract, with an average premium of 95 yuan/mt, up 40 yuan/mt from the previous trading day. SX-EW copper was quoted at a discount of 20 yuan/mt to 0 yuan/mt, with an average discount of 10 yuan/mt, up 30 yuan/mt from the previous trading day. The average price of #1 copper cathode in Guangdong was 80,070 yuan/mt, up 1,205 yuan/mt from the previous trading day, while the average price of SX-EW copper was 79,965 yuan/mt, up 1,195 yuan/mt from the previous trading day.

Spot Market: Guangdong's inventory has declined for three consecutive days, primarily due to still low arrivals and increased outflows from warehouses. Currently, the market is trading cargoes with invoices dated next month, with the impact of mid-year settlements being minimal. Suppliers have shifted from previous liquidation sales to refusing to budge on prices amid ongoing inventory declines, ignoring the significant rise in copper prices. As a result, premiums have risen significantly today compared to yesterday. As of 11 a.m., high-quality copper for the front-month contract was quoted at a premium of 150 yuan/mt, standard-quality copper at a premium of 40 yuan/mt, and SX-EW copper at a discount of 10 yuan/mt. Continue to monitor whether inventory will continue to decline next week; if so, premiums are expected to rise further.

Overall, with inventory declining for three consecutive days and suppliers actively refusing to budge on prices, downstream buyers are hesitant to purchase due to high prices, resulting in weaker trading volume today compared to yesterday.